Introduction:

In the pursuit of financial empowerment, understanding economic indicators is a crucial skill. This article explores the significance of economic indicators, their impact on financial markets, and the role of financial literacy in empowering women to navigate the complexities of the financial world.

The Importance of Economic Indicators:

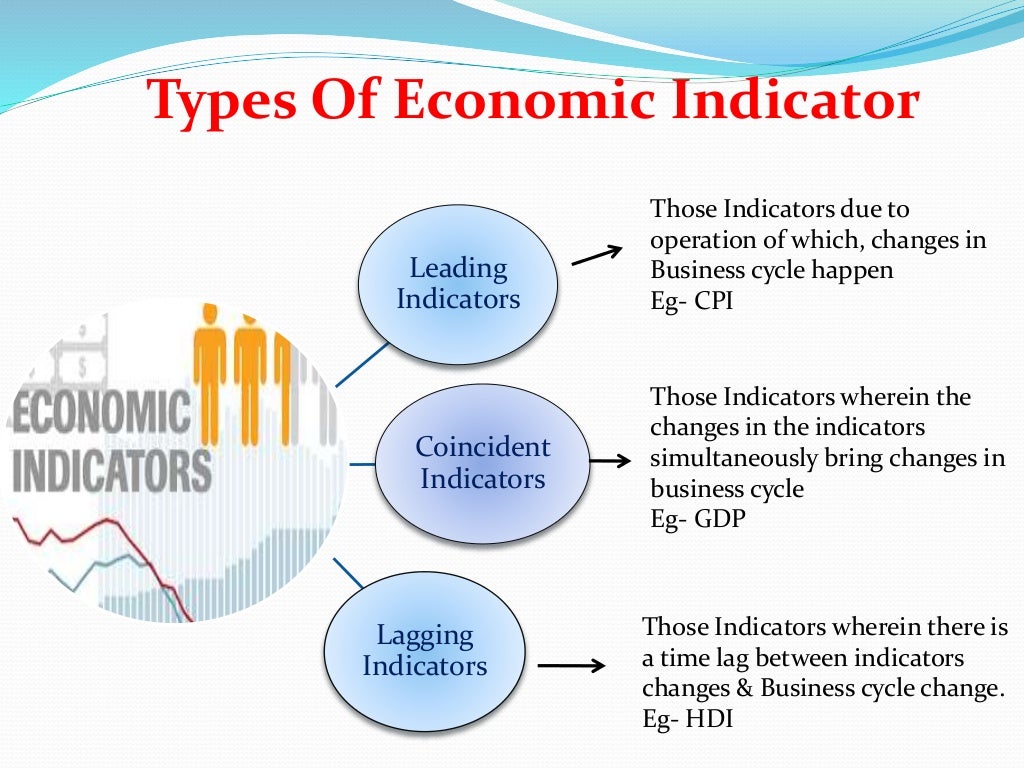

- Defining Economic Indicators: Economic indicators are statistical measures that provide insights into the health and performance of an economy. They help analysts and investors gauge the direction of economic trends.

- Key Economic Indicators:

- Gross Domestic Product (GDP): Measures the total value of goods and services produced in a country.

- Unemployment Rate: Indicates the percentage of the labor force without employment.

- Inflation Rate: Measures the rate at which the general level of prices for goods and services rises.

- Impact on Financial Markets:

- Economic indicators influence investor sentiment and market behavior.

- Positive economic indicators may lead to increased confidence, driving stock market gains.

- Negative indicators can trigger market volatility and impact investment decisions.

Financial Literacy for Women: A Path to Empowerment:

- Closing the Financial Literacy Gap:

- Despite progress, a gender gap in financial literacy persists.

- Empowering women with financial knowledge is essential for making informed decisions and achieving economic independence.

- Understanding Personal Finances:

- Financial literacy starts with understanding personal finances, including budgeting, saving, and investing.

- Women who grasp these fundamentals can make strategic decisions aligned with their financial goals.

- Investment Education for Women:

- Providing women with investment education is crucial for fostering confidence in navigating financial markets.

- Understanding economic indicators allows women to make informed investment choices based on broader economic trends.

- Entrepreneurial Financial Literacy:

- Women entrepreneurs benefit from financial literacy in managing business finances, accessing capital, and making strategic financial decisions for business growth.

- Retirement Planning:

- Financial literacy empowers women in planning for retirement, ensuring they have the knowledge to make sound investment choices and secure their financial future.

- Financial literacy empowers women in planning for retirement, ensuring they have the knowledge to make sound investment choices and secure their financial future.

- Negotiating and Closing the Gender Pay Gap:

- Financial literacy equips women to negotiate salaries and benefits, contributing to closing the gender pay gap.

- Understanding economic indicators related to employment and income trends enhances negotiation skills.

- Building Confidence in Financial Decision-Making:

- Financial literacy builds confidence, encouraging women to actively participate in financial discussions and take charge of their financial destinies.

- Understanding economic indicators provides a foundation for making informed decisions in a rapidly changing economic landscape.

Empowering Females in Financial Markets:

- Educational Initiatives:

- Promote educational initiatives that specifically target financial literacy for women.

- Workshops, seminars, and online resources can provide valuable insights into economic indicators and financial decision-making.

- Female Mentorship Programs:

- Establish mentorship programs where experienced women in finance guide and share their expertise with younger generations.

- Mentorship fosters a supportive environment for women to enhance their financial knowledge.

- Inclusive Investment Platforms:

- Advocate for more inclusive investment platforms that cater to the specific needs and preferences of women.

- Platforms that provide educational resources and personalized investment advice contribute to financial empowerment.

- Community Support and Networks:

- Create communities and networks where women can share experiences, knowledge, and strategies for financial success.

- Collective support enhances financial literacy and empowers women to navigate financial markets with confidence.

Conclusion:

Understanding economic indicators is a fundamental aspect of financial literacy, especially for women seeking empowerment in the financial world. By bridging the financial literacy gap, providing targeted education, and fostering supportive communities, we can empower women to navigate financial markets with confidence. As women gain a deeper understanding of economic indicators, they position themselves to make informed decisions, build wealth, and contribute to closing gender financial gaps. In embracing financial literacy, women not only secure their own financial futures but also contribute to a more inclusive and economically empowered society.