Introduction:

As the world becomes increasingly aware of the environmental and social challenges we face, sustainable finance has emerged as a powerful avenue for individuals to contribute to positive change. Investing with a focus on sustainability and ethics is not only a responsible financial strategy but also a way to foster a greener and more ethical future. In this article, we’ll explore the concept of sustainable finance, the principles of ethical investing, and the impact these practices can have on creating a sustainable world.

Understanding Sustainable Finance:

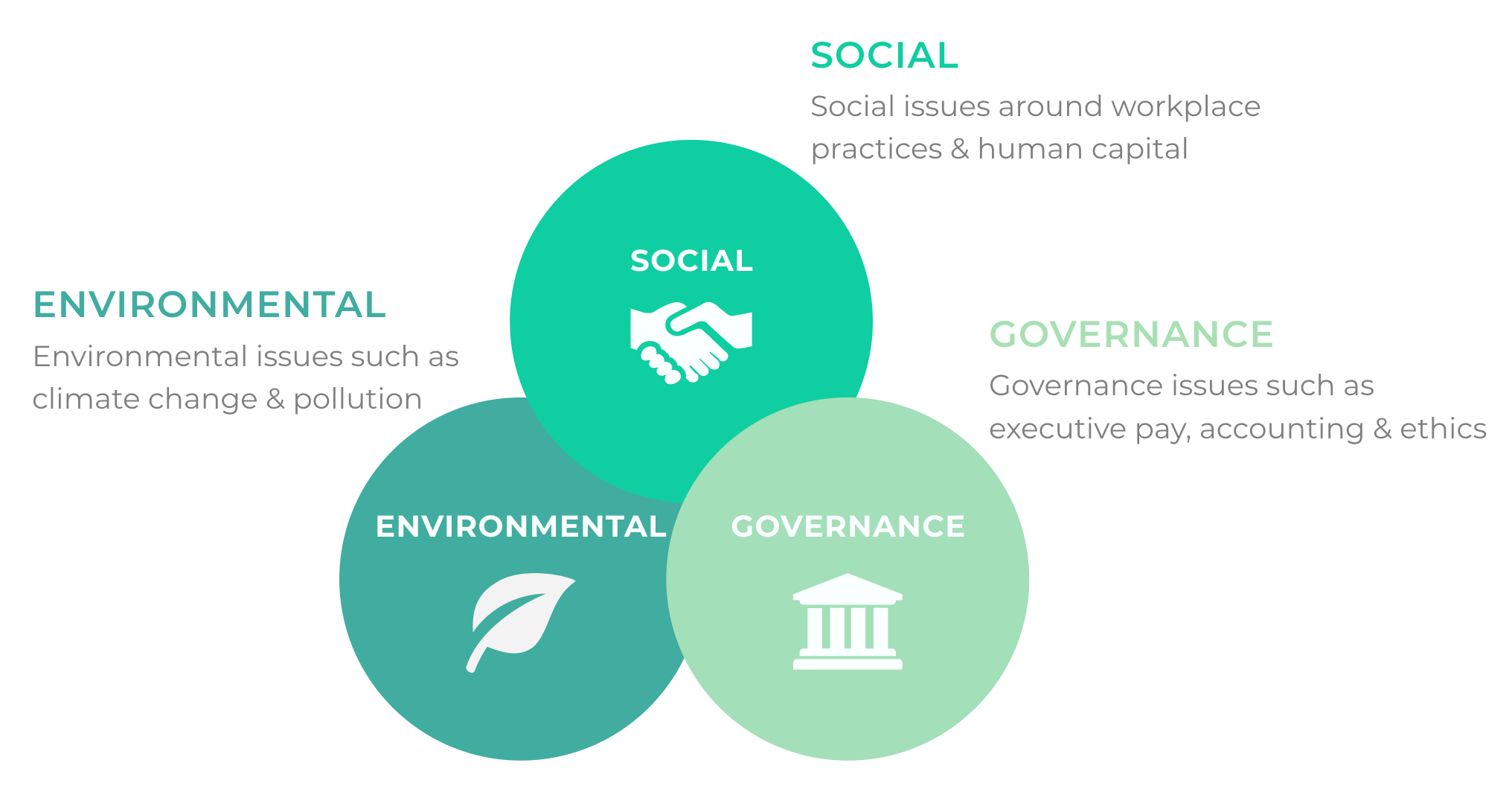

- Environmental, Social, and Governance (ESG) Criteria: Sustainable finance involves considering not only financial returns but also the environmental, social, and governance impact of investments. Companies and projects are evaluated based on ESG criteria to ensure they align with sustainable and ethical principles.

- Long-Term Value Creation: Sustainable finance emphasizes long-term value creation over short-term gains. Investors seek opportunities that contribute positively to environmental conservation, social well-being, and ethical governance, recognizing the significance of responsible business practices.

- Impact Investing: Impact investing focuses on generating positive, measurable social and environmental impact alongside financial returns. This approach allows investors to actively contribute to solutions for global challenges such as climate change, poverty, and inequality.

Principles of Ethical Investing:

- Environmental Sustainability: Ethical investing includes supporting companies and projects committed to environmental sustainability. This may involve investments in renewable energy, clean technology, or initiatives that promote conservation and reduce carbon footprints.

- Social Responsibility: Ethical investors prioritize companies that demonstrate social responsibility. This includes fair labor practices, diversity and inclusion initiatives, and contributions to community development.

- Governance and Ethical Practices: Governance plays a crucial role in ethical investing. Investors look for companies with transparent and ethical practices, strong corporate governance, and a commitment to upholding human rights.

- Avoidance of Controversial Industries: Ethical investors often avoid industries associated with controversial activities such as tobacco, weapons, or companies involved in human rights violations. The aim is to align investments with personal values and principles.

The Impact of Sustainable Finance:

- Driving Positive Change: Sustainable finance enables individuals to be agents of positive change. By directing capital towards sustainable and ethical initiatives, investors contribute to building a more sustainable and responsible global economy.

- Encouraging Corporate Responsibility: The demand for sustainable investments encourages corporations to adopt more responsible practices. Companies that prioritize sustainability and ethical conduct are likely to attract investment, fostering a shift toward responsible business behavior.

- Addressing Global Challenges: Sustainable finance addresses critical global challenges such as climate change, social inequality, and environmental degradation. By directing capital towards solutions, investors actively participate in addressing these challenges on a systemic level.

- Enhancing Market Resilience: Investing in sustainable and ethical projects can enhance market resilience. Companies that prioritize sustainability are better positioned to navigate long-term challenges, including regulatory changes, resource scarcity, and shifting consumer preferences.

Practical Steps for Ethical Investors:

- Research and Due Diligence: Conduct thorough research on investment options. Look for companies with transparent ESG disclosures, ethical governance, and a commitment to sustainability. Utilize ESG ratings and reports to inform your investment decisions.

- Engage with Companies: Ethical investors can actively engage with companies to advocate for positive change. Participate in shareholder resolutions, attend annual meetings, and communicate with companies to express your expectations regarding sustainability and ethical practices.

- Diversify Your Portfolio: Diversify your investment portfolio with a mix of sustainable assets. This may include investments in green bonds, renewable energy projects, socially responsible mutual funds, and companies with strong ESG profiles.

- Stay Informed and Advocate: Stay informed about developments in sustainable finance and advocate for responsible investment practices. Join sustainable finance forums, participate in discussions, and support initiatives that promote ethical investing.

Conclusion:

Sustainable finance and ethical investing offer individuals an opportunity to align their financial goals with a broader vision for a greener and more ethical future. By integrating environmental, social, and governance criteria into investment decisions, investors can actively contribute to positive change while pursuing financial returns. The impact of sustainable finance extends beyond individual portfolios, influencing corporate practices and addressing global challenges. As individuals, we have the power to shape the future through our investment choices. Investing with a focus on sustainability and ethics is not just a financial strategy; it’s a commitment to creating a world that prioritizes the well-being of both people and the planet.