Introduction:

Investing in real estate has long been considered a powerful strategy for building wealth and generating income. Navigating the dynamic property market with confidence requires a strategic approach, thorough research, and a keen understanding of the factors that influence real estate investments. In this article, we’ll explore key considerations to empower you in making confident decisions as you venture into the realm of real estate investments.

Understanding the Appeal of Real Estate Investments:

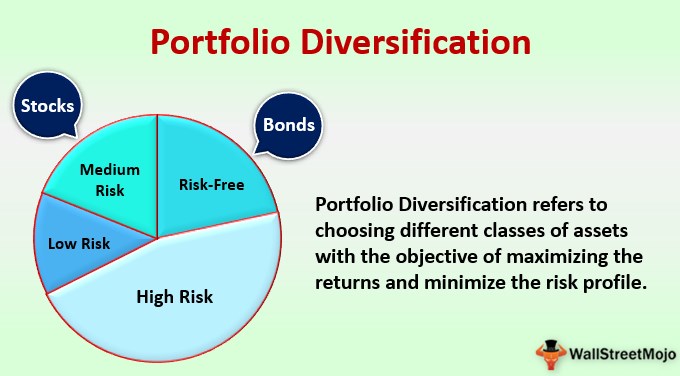

- Diversification of Portfolio: Real estate offers diversification benefits to an investment portfolio. Adding real estate assets can reduce risk and enhance overall portfolio performance, especially when compared to traditional investments like stocks and bonds.

- Potential for Appreciation: Real estate has the potential for long-term appreciation. Properties in desirable locations may see value appreciation over time, providing investors with capital gains when they decide to sell.

- Steady Income through Rent: Rental income from real estate properties can offer a consistent and reliable source of cash flow. This steady income stream can be particularly attractive for investors seeking passive income.

Confident Navigation in the Real Estate Market:

- Define Your Investment Goals: Clearly define your investment goals before entering the real estate market. Determine whether you are looking for long-term capital appreciation, steady rental income, or a combination of both. Your goals will shape your investment strategy.

- Thorough Market Research: Conduct comprehensive research on the local real estate market. Analyze property values, rental trends, and economic indicators. Understanding the current and potential future state of the market is essential for making informed investment decisions.

- Risk Assessment: Assess the risks associated with real estate investments, including market volatility, potential vacancies, and financing risks. Develop risk mitigation strategies and ensure that your investment aligns with your risk tolerance.

- Financing Options: Explore financing options and understand the implications of different mortgage terms, interest rates, and loan structures. A sound financing strategy can significantly impact the profitability of your real estate investments.

- Property Selection: Choose properties based on careful consideration of location, property type, and potential for future growth. Conduct thorough due diligence, inspect properties, and consider factors such as neighborhood amenities, school districts, and local economic trends.

- Professional Guidance: Engage with real estate professionals, including real estate agents, property managers, and financial advisors. Their expertise can provide valuable insights and guidance, especially for those new to real estate investing.

- Maintenance and Management: Factor in the costs and responsibilities associated with property maintenance and management. Whether you manage properties yourself or hire a property management company, a proactive approach to maintenance is crucial for preserving property value.

Conclusion:

Navigating the real estate market with confidence involves a combination of strategic planning, thorough research, and a clear understanding of your investment goals. By defining your objectives, conducting market research, assessing risks, exploring financing options, carefully selecting properties, seeking professional guidance, and managing properties effectively, you can position yourself for success in the world of real estate investments. Remember, a well-informed and strategic approach will empower you to confidently navigate the property market and unlock the potential for long-term financial success.