Introduction:

In the ever-changing landscape of financial markets, seasoned investors understand that mastering the stock market goes beyond basic knowledge. It requires a deep understanding of advanced strategies that not only sustain but also enhance financial resilience. This article will explore advanced tactics for seasoned investors to navigate economic challenges, bounce back from setbacks, and achieve lasting financial resilience.

The Significance of Financial Resilience:

Financial resilience is the ability to withstand economic challenges, adapt to unforeseen circumstances, and bounce back stronger after setbacks. Seasoned investors recognize the importance of not only growing wealth but also fortifying it against the inherent volatility of financial markets.

Advanced Strategies for Achieving Financial Resilience:

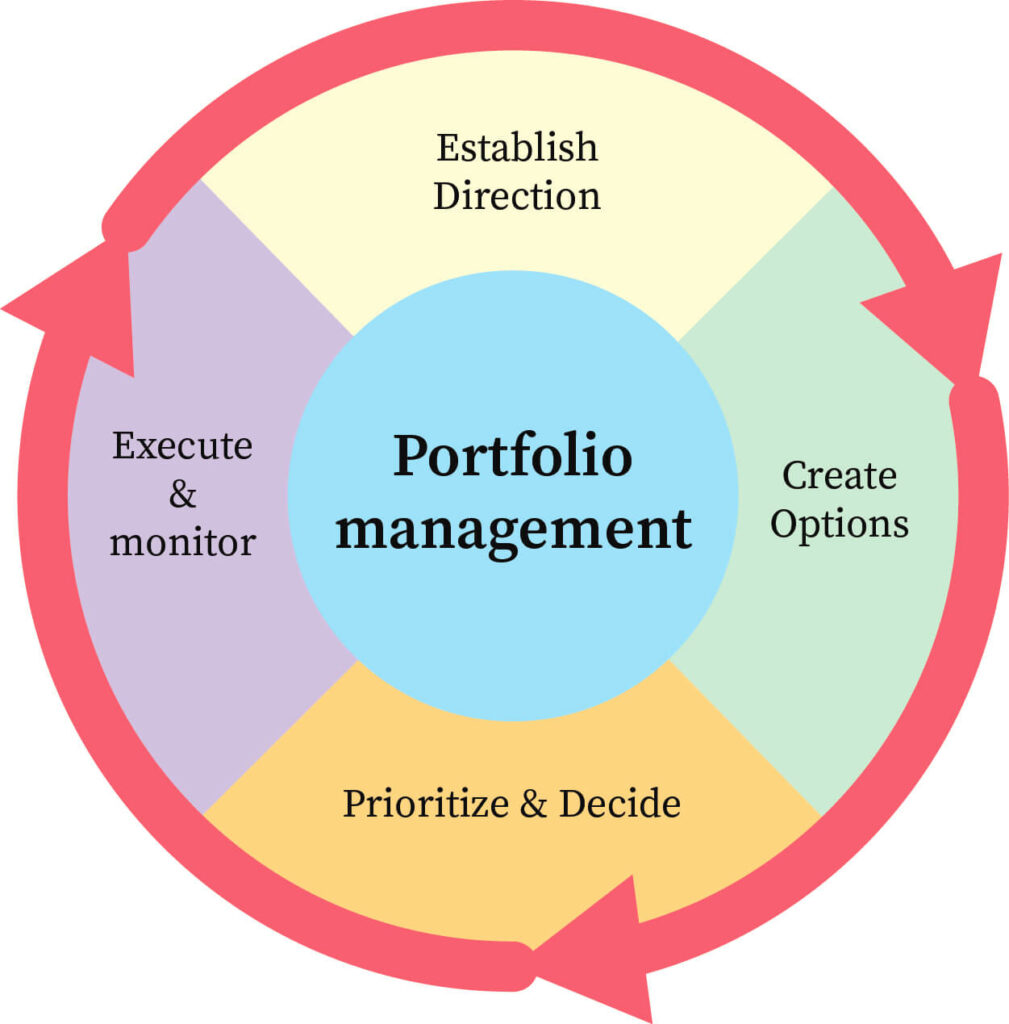

- Active Portfolio Management: Seasoned investors engage in active portfolio management, regularly reassessing their holdings and adjusting allocations based on market conditions. This strategy allows for a proactive response to economic challenges, ensuring that the portfolio remains resilient.

- Risk Mitigation Techniques: Implement advanced risk mitigation techniques, such as using options or incorporating hedging strategies. These tools can help protect investments during periods of market turbulence and contribute to overall financial resilience.

- Diversification Beyond Asset Classes: While traditional diversification involves spreading investments across asset classes, seasoned investors take it a step further by diversifying within asset classes. This nuanced approach helps mitigate risks associated with specific industries or sectors.

Bouncing Back from Economic Challenges:

- Adaptability and Flexibility: The ability to adapt to changing economic conditions is key to bouncing back from challenges. Seasoned investors remain flexible, adjusting their strategies based on market dynamics and staying ahead of trends.

- Contrarian Investing: Consider adopting contrarian investing strategies during economic downturns. Contrarian investors go against prevailing market sentiment, often identifying valuable opportunities when others are cautious or pessimistic.

- Continuous Learning: Stay informed and continuously expand your knowledge. Seasoned investors understand that markets evolve, and staying ahead requires a commitment to lifelong learning. Regularly analyze market trends, economic indicators, and global events that may impact investments.

Navigating Economic Challenges:

- Stress Testing Portfolios: Conduct stress tests on your investment portfolio to assess its resilience under various economic scenarios. Identifying potential weaknesses allows for strategic adjustments and better prepares investors for economic challenges.

- Liquidity Management: Maintain a careful balance between investment liquidity and long-term growth. Having sufficient liquidity provides the flexibility to capitalize on opportunities during economic downturns or take advantage of undervalued assets.

- Strategic Asset Allocation: Develop a strategic asset allocation plan that aligns with your financial goals and risk tolerance. Adjust this plan periodically to account for changes in market conditions, ensuring a resilient and adaptable investment strategy.

Conclusion:

For seasoned investors, mastering the stock market involves more than just maximizing returns; it encompasses achieving and sustaining financial resilience. By implementing advanced strategies, bouncing back from economic challenges, and navigating market uncertainties with adaptability, investors can fortify their portfolios and ensure long-term success. Embrace the dynamic nature of financial markets, continuously refine your strategies, and let financial resilience be the guiding force in your journey toward lasting investment success.