Introduction:

In times of financial uncertainty, mastering credit becomes a cornerstone of financial stability. A stellar credit score not only opens doors to better financial opportunities but also positions individuals to thrive in turbulent times. In this article, we’ll delve into strategies for building and maintaining an excellent credit score, ensuring a solid foundation for successful investment strategies even in challenging economic climates.

Building a Strong Credit Foundation:

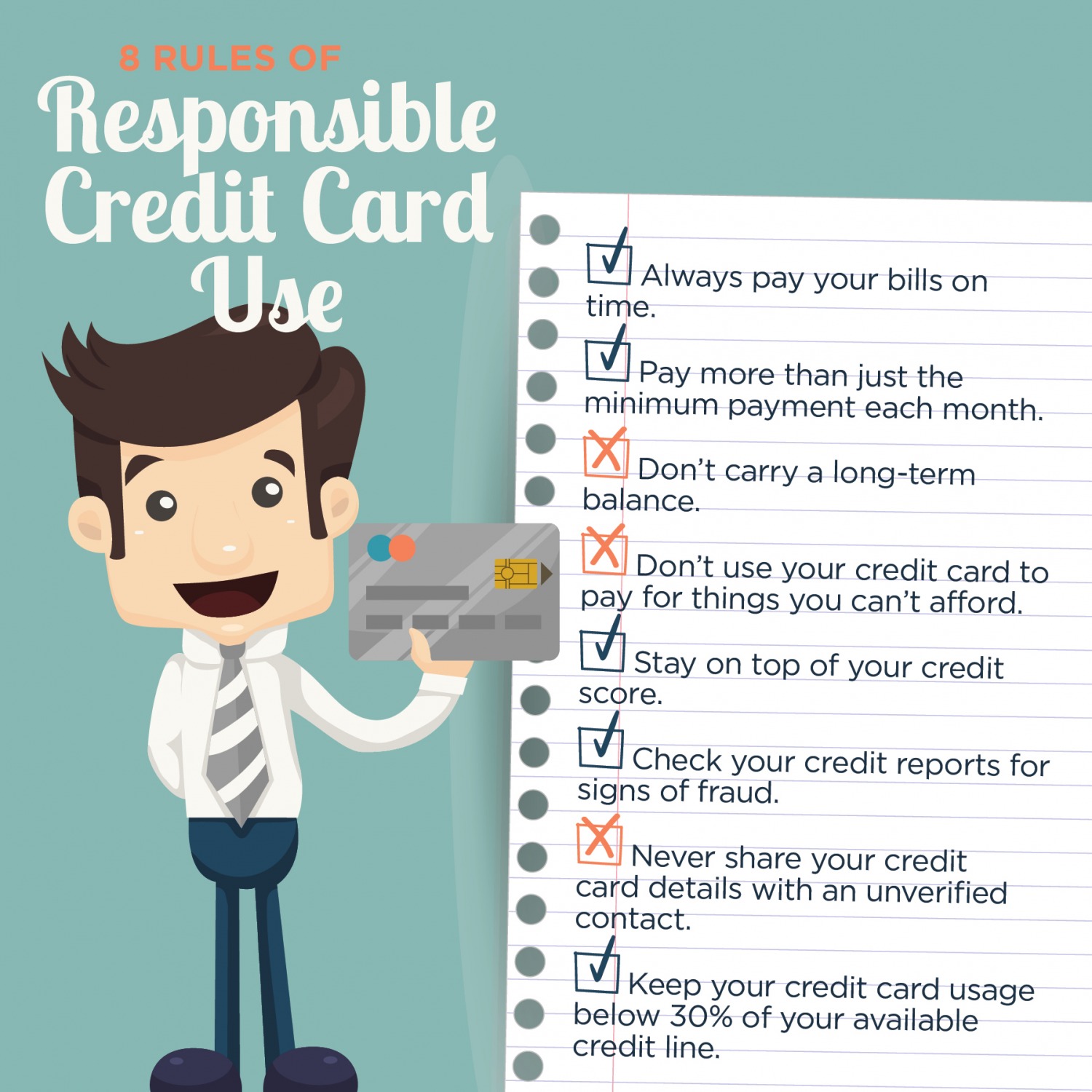

- Establishing Responsible Credit Habits: Start by establishing responsible credit habits. Timely payments, low credit utilization, and cautious borrowing contribute to a positive credit history. These foundational habits set the stage for a stellar credit score.

- Diversifying Credit Types: Diversification is key to a robust credit profile. Mix different types of credit, such as credit cards and installment loans, to showcase a well-rounded financial portfolio. A diverse credit mix can positively impact your credit score.

- Gradually Increasing Credit Limits: Requesting gradual increases in credit limits can contribute to a lower credit utilization ratio, a crucial factor in credit scoring. Be cautious not to increase spending in tandem with credit limit increases to maintain financial responsibility.

Maintaining a Stellar Credit Score in Turbulent Times:

- Regularly Monitoring Credit Reports: In turbulent economic climates, vigilance is crucial. Regularly monitor your credit reports for inaccuracies or signs of identity theft. Quick identification and resolution of issues can help maintain a high credit score.

- Emergency Fund for Financial Stability: Building and maintaining an emergency fund is not only a responsible financial strategy but also a safeguard for your credit score in uncertain times. Having a financial buffer ensures that unexpected expenses won’t compromise your creditworthiness.

- Strategic Debt Management: While managing debt is essential, strategic debt management is crucial during turbulent times. Prioritize high-interest debts, explore debt consolidation options, and consider negotiating with creditors to ease financial burdens without impacting your credit score negatively.

Thriving with Investment Strategies:

- Diversified Investment Portfolios: In uncertain economic climates, diversification is key to investment success. Spread your investments across different asset classes to mitigate risk. A well-diversified portfolio positions you to thrive even in turbulent times.

- Strategic Asset Allocation: Adjust your asset allocation based on changing market conditions. Regularly reassess your investment portfolio, identifying opportunities to rebalance and optimize your holdings. This strategic approach can enhance your ability to thrive despite economic challenges.

- Continuous Learning and Adaptation: Thriving in turbulent times requires continuous learning and adaptation. Stay informed about market trends, economic indicators, and potential investment opportunities. Being proactive and adaptable positions you to make informed decisions that contribute to long-term success.

Conclusion:

Mastering credit is a dynamic process that extends beyond individual financial goals, especially in turbulent economic times. By building and maintaining a stellar credit score through responsible habits, vigilance, and strategic debt management, individuals can position themselves to thrive with sound investment strategies. Embrace the connection between credit mastery and financial success, and let your stellar credit score be the cornerstone of resilience and prosperity in both stable and turbulent economic climates.