Introduction:

Insurance is a powerful financial tool that provides a safety net for individuals and families, offering protection against unforeseen circumstances. Understanding the intricacies of insurance is crucial for safeguarding your assets and ensuring the well-being of your loved ones. In this article, we’ll decode the world of insurance, exploring its various facets and emphasizing the importance of asset protection and the security of your loved ones.

The Role of Insurance in Asset Protection:

- Asset Protection Defined: Asset protection involves safeguarding your financial resources and valuable possessions from potential risks and liabilities. Insurance is a fundamental component of any comprehensive asset protection strategy.

- Types of Insurance for Asset Protection: a. Homeowners Insurance: Protects your home and personal belongings from damage or loss due to covered events such as fire, theft, or natural disasters.

b. Auto Insurance: Covers damages and liabilities related to your vehicle, providing financial protection in the event of accidents, theft, or vandalism.

c. Renters Insurance: Similar to homeowners insurance but tailored for renters, covering personal property and providing liability coverage.

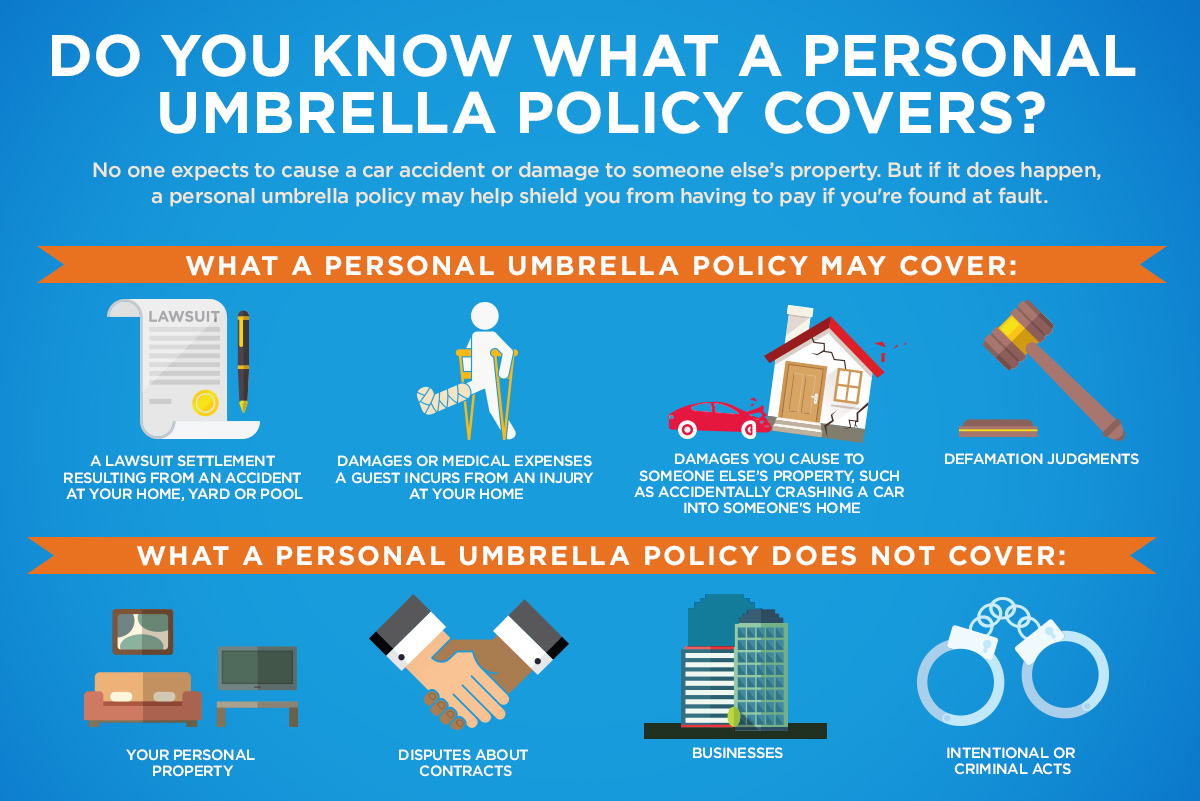

d. Umbrella Insurance: Offers additional liability coverage beyond the limits of standard homeowners and auto insurance policies, providing a higher level of protection.

e. Life Insurance: Ensures financial security for your loved ones by providing a death benefit in the event of your passing. It can also serve as an investment or savings tool.

f. Disability Insurance: Provides income replacement if you are unable to work due to a disability. It safeguards your ability to meet financial obligations in challenging times.

The Importance of Protecting Loved Ones:

- Life Insurance for Family Security: Life insurance is a crucial tool for protecting your loved ones’ financial future. It can cover funeral expenses, outstanding debts, and provide a financial cushion for the family in the absence of the primary earner.

- Health Insurance for Well-Being: Health insurance ensures access to quality healthcare without incurring exorbitant medical expenses. It protects your family’s well-being by covering medical treatments, prescriptions, and preventive care.

- Umbrella Insurance for Liability Protection: An umbrella insurance policy provides an extra layer of liability protection, shielding your family from potential lawsuits and financial consequences that may arise from accidents or incidents involving you or your property.

Tips for Effective Insurance Planning:

- Assess Your Needs: Conduct a thorough evaluation of your assets, liabilities, and family situation to determine the types and amounts of insurance coverage you need.

- Regularly Review Policies: Periodically review your insurance policies to ensure they align with your current circumstances. Adjust coverage levels as needed, especially after significant life events such as marriage, the birth of a child, or the acquisition of new assets.

- Compare Quotes: Shop around and compare quotes from different insurance providers to ensure you get the best coverage at competitive rates. Don’t hesitate to negotiate or inquire about discounts.

- Understand Policy Terms: Familiarize yourself with the terms and conditions of your insurance policies. Understand the coverage limits, exclusions, deductibles, and any additional features or riders.

- Seek Professional Advice: Consult with insurance professionals or financial advisors to get personalized guidance on the types and amounts of coverage that suit your unique needs and financial goals.

Conclusion:

Insurance is a cornerstone of responsible financial planning, providing a safety net for your assets and loved ones. Whether it’s protecting your home, vehicle, health, or income, insurance plays a crucial role in mitigating risks and providing financial security. By understanding the types of insurance available, recognizing the importance of asset protection, and regularly reviewing and adjusting your policies, you can navigate the world of insurance with confidence. Remember, insurance isn’t just about protecting possessions; it’s about safeguarding the people and relationships that matter most in your life.