Introduction:

Frugal living is not about deprivation; it’s a strategic and mindful approach to managing finances. In this article, we’ll explore frugal living hacks that allow you to maximize savings without compromising quality. Additionally, we’ll delve into the importance of diversifying investments to build a robust financial portfolio.

Frugal Living Hacks for Maximizing Savings:

- Meal Planning and Batch Cooking:

- Plan your meals for the week to avoid impulsive and expensive food choices.

- Embrace batch cooking to prepare larger quantities of meals and freeze portions for later, reducing the need for dining out or ordering takeout.

- Embracing Secondhand Shopping:

- Explore thrift stores, consignment shops, and online marketplaces for high-quality items at a fraction of the cost.

- Consider buying gently used furniture, clothing, and electronics to save money while still acquiring durable and reliable items.

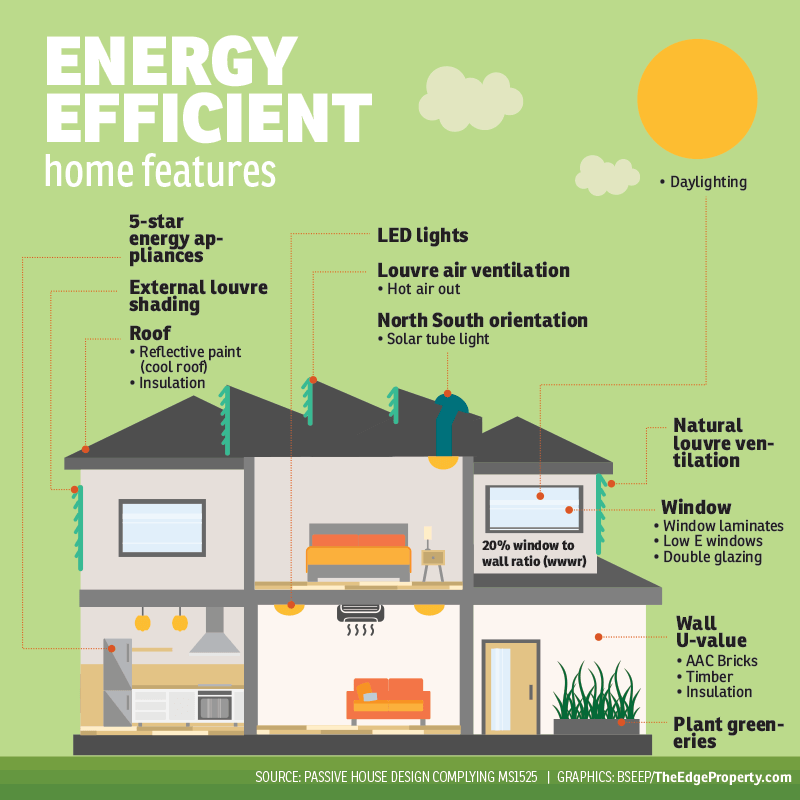

- Energy Efficiency at Home:

- Invest in energy-efficient appliances to lower utility bills over time.

- Adopt energy-saving habits, such as turning off lights when not in use, unplugging electronics, and using programmable thermostats.

- DIY Projects for Cost Savings:

- Learn basic DIY skills for home repairs, maintenance, and simple projects.

- Explore online tutorials for DIY solutions to common problems, reducing the need for professional services.

- Subscription Audits:

- Regularly review and assess subscriptions to streaming services, magazines, and other recurring expenses.

- Cancel subscriptions that no longer provide significant value or are underutilized.

Maximizing Savings with Smart Strategies:

- Automated Savings:

- Set up automatic transfers to a savings account to ensure a consistent contribution to your savings each month.

- Treat savings as a non-negotiable expense to prioritize financial goals.

- Emergency Fund Priority:

- Build and maintain an emergency fund to cover unexpected expenses and prevent reliance on credit in times of need.

- Aim to save three to six months’ worth of living expenses in your emergency fund.

- Negotiating Bills:

- Regularly review bills for services such as utilities, insurance, and internet.

- Negotiate with service providers to secure better rates or discounts, potentially saving a significant amount over time.

Diversifying Investments for a Robust Financial Portfolio:

- Understanding Diversification:

- Diversifying investments involves spreading your money across different asset classes, industries, and geographic regions.

- The goal is to reduce risk and optimize returns by not putting all your financial eggs in one basket.

- Balancing Risk and Reward:

- Different asset classes carry varying levels of risk and potential returns. Balancing these factors based on your risk tolerance and financial goals is crucial.

- Consider a mix of stocks, bonds, real estate, and other investment vehicles to create a well-rounded portfolio.

- Investing in Index Funds:

- Index funds provide broad market exposure and are known for their low fees.

- Consider incorporating index funds into your investment portfolio for a cost-effective and diversified approach.

- Exploring Real Estate Investments:

- Real estate investments, through avenues like Real Estate Investment Trusts (REITs) or rental properties, can add diversification and potential income to your portfolio.

- Research and understand the real estate market before making investment decisions.

- Regular Portfolio Reviews:

- Periodically review your investment portfolio to ensure it aligns with your financial goals and risk tolerance.

- Make adjustments as needed based on changes in the market or your personal circumstances.

Conclusion:

Frugal living hacks and smart savings strategies empower individuals to maximize their financial resources without compromising quality. By adopting frugal habits, prioritizing savings, and making mindful financial choices, individuals can build a solid foundation for financial success. Additionally, diversifying investments contributes to the creation of a robust financial portfolio, enhancing long-term financial security. The synergy of frugal living and diversified investments forms a powerful approach to achieving financial goals and navigating the complexities of the financial landscape.