Introduction:

In the face of economic challenges, the concept of financial resilience takes center stage. Achieving and maintaining financial resilience involves strategic planning and the application of advanced budgeting techniques. This article will explore how individuals can bounce back from economic challenges by implementing sophisticated budgeting strategies within their financial plan.

The Significance of Financial Resilience:

Financial resilience is the ability to withstand economic shocks, adapt to changes, and recover swiftly from setbacks. It is a dynamic concept that requires a proactive approach to financial management, with advanced budgeting playing a crucial role in fortifying one’s financial position.

Advanced Budgeting Techniques:

- Zero-Based Budgeting: Unlike traditional budgeting, zero-based budgeting requires assigning every dollar a specific purpose. This technique encourages a meticulous examination of expenses, ensuring that each item aligns with financial goals. It’s a proactive approach that enhances control over spending.

- Dynamic Budget Adjustments: Financial resilience demands flexibility. Advanced budgeters regularly reassess their financial plan, making dynamic adjustments based on changes in income, expenses, or economic conditions. This adaptability ensures that the budget remains a relevant and effective tool.

- Rolling Budgets: Rather than planning for an entire year, consider adopting rolling budgets that cover shorter periods, such as three or six months. This allows for more frequent reassessment and adjustment, keeping the budget agile and responsive to economic challenges.

Incorporating Advanced Budgeting into Your Financial Plan:

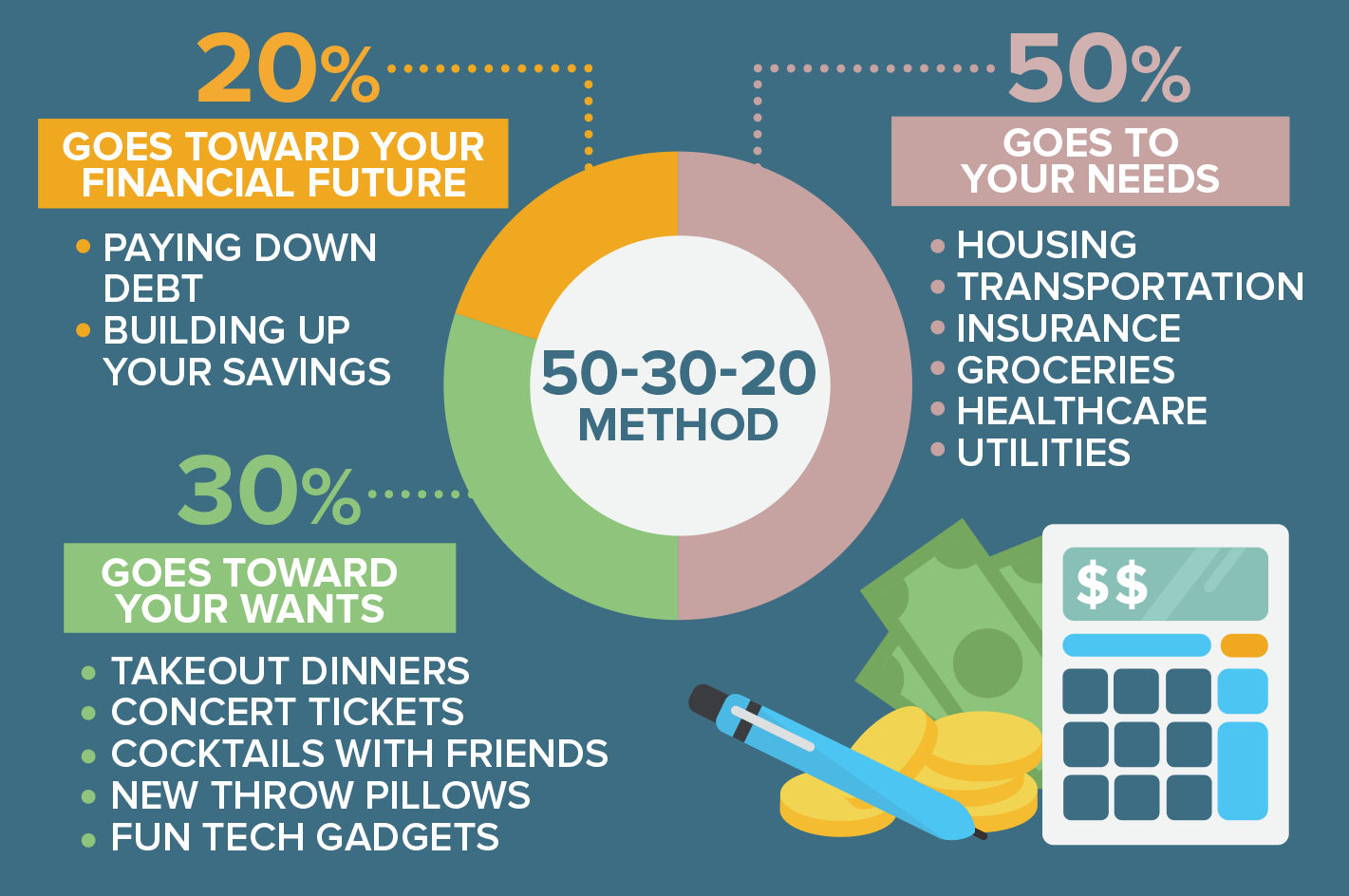

- Thorough Expense Categorization: Break down expenses into granular categories for a detailed understanding of where money is going. This level of categorization enables better control and identification of areas for potential savings or reallocation.

- Emergency Fund Integration: Advanced budgeting involves not only accounting for regular expenses but also integrating emergency fund contributions as a non-negotiable item. Establishing and consistently contributing to an emergency fund enhances financial resilience by providing a safety net during economic challenges.

- Investment Budgeting: Include an investment budget as part of your overall financial plan. Allocate funds strategically for investment opportunities, whether in the stock market, real estate, or other vehicles. This helps grow wealth and diversify income sources.

Bouncing Back with Advanced Budgeting Techniques:

- Debt Management Strategies: Implement advanced debt management techniques within your budget. Prioritize high-interest debt repayment, explore debt consolidation options, and strategically leverage low-interest rates to manage debt more effectively during economic challenges.

- Scenario Planning: Engage in scenario planning within your budget to anticipate various economic scenarios. This proactive approach allows you to assess the impact of potential changes in income, expenses, or market conditions, empowering you to make informed decisions in advance.

- Continuous Monitoring and Adjustment: Financial resilience is an ongoing process. Regularly monitor your budget, track your progress, and be prepared to make adjustments as needed. This continuous refinement ensures that your financial plan remains a robust tool for navigating economic challenges.

Conclusion:

Financial resilience is not a passive state but an active, strategic approach to financial management. By incorporating advanced budgeting techniques into your financial plan, you can bounce back from economic challenges with resilience and confidence. Embrace a proactive mindset, refine your budget regularly, and let advanced budgeting be the cornerstone of your journey towards lasting financial strength.