Introduction:

A financial health checkup is a crucial aspect of maintaining a secure and resilient financial foundation. In this article, we’ll delve into the realm of cryptocurrency investments and digital coins, exploring how they can be a part of your financial portfolio and how to assess and improve your overall money situation through strategic considerations in the cryptocurrency space.

Understanding Cryptocurrency Investments:

- Introduction to Cryptocurrency: Cryptocurrencies are digital or virtual currencies that use cryptography for security and operate on decentralized networks based on blockchain technology. Bitcoin, Ethereum, and a multitude of alternative digital coins have emerged, presenting new opportunities for investors.

- Diversification with Cryptocurrency: Diversifying your investment portfolio is a fundamental strategy for managing risk. Cryptocurrency investments offer an additional avenue for diversification, especially given their potential for non-correlation with traditional financial markets.

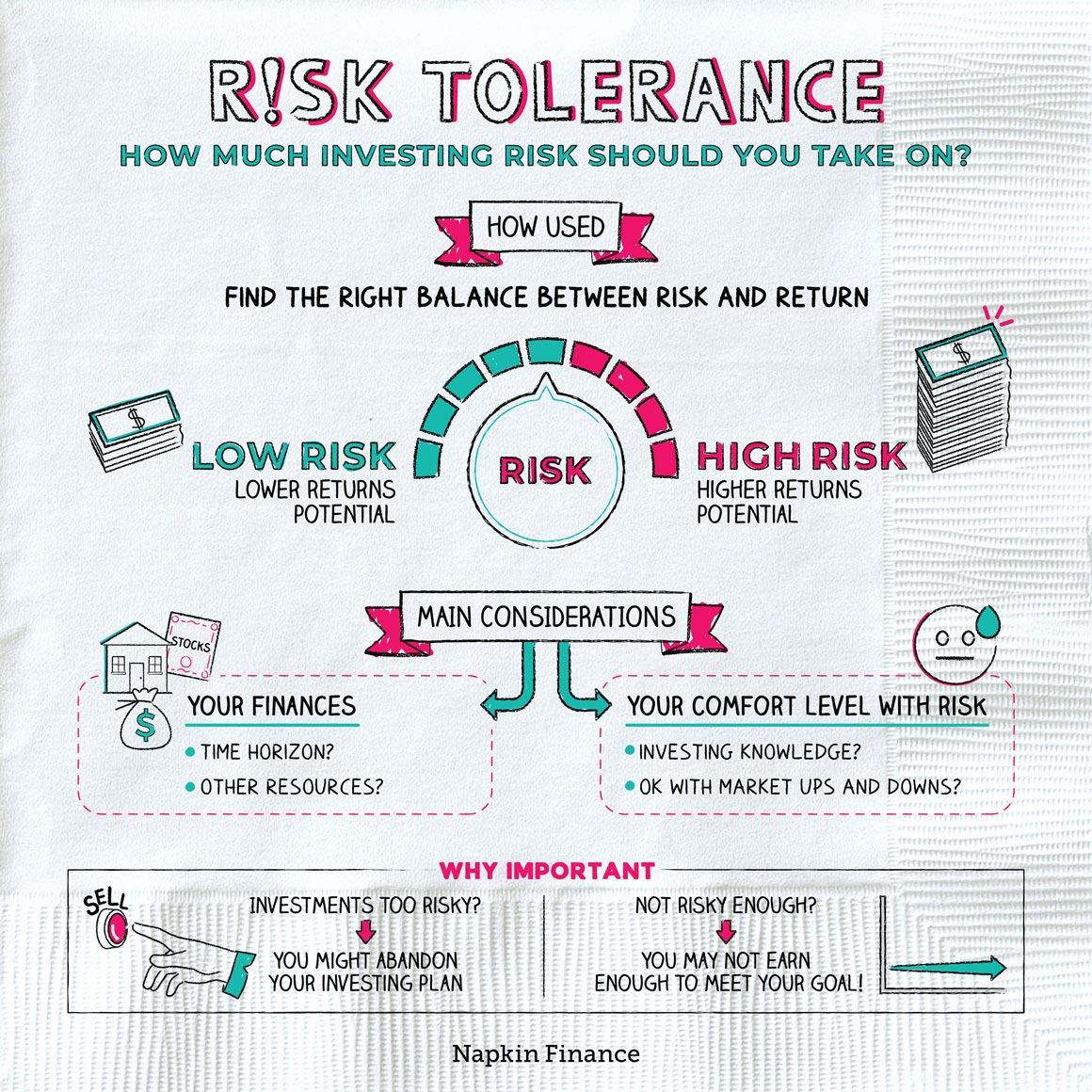

- Assessing Risk Tolerance: Before venturing into cryptocurrency investments, assess your risk tolerance. Cryptocurrencies are known for their price volatility, and while they present opportunities for significant returns, they also carry inherent risks. Evaluate how comfortable you are with the potential for price fluctuations.

- Educate Yourself: Cryptocurrency markets can be complex, and staying informed is key to making informed decisions. Educate yourself on the fundamentals of blockchain technology, the specific features of different cryptocurrencies, and the factors that influence their value. Understanding the market dynamics enhances your ability to navigate it successfully.

- Start with a Small Allocation: If you are new to cryptocurrency investments, consider starting with a small allocation of your overall investment portfolio. This approach allows you to test the waters, observe market behavior, and gradually increase your exposure based on your comfort level and experience.

- Secure Storage Solutions: Security is paramount in the cryptocurrency space. Utilize secure digital wallets, including hardware wallets, to store your digital coins. Implementing robust security measures protects your investments from potential cyber threats.

- Long-Term Perspective: Cryptocurrency markets are known for their short-term volatility, but adopting a long-term perspective can be beneficial. Instead of succumbing to market fluctuations, focus on the underlying technology, adoption trends, and the potential for sustained growth over time.

Improving Your Money Situation with Digital Coins:

- Budgeting and Financial Planning: A financial health checkup begins with sound budgeting and financial planning. Incorporate your cryptocurrency investments into your overall financial strategy, ensuring they align with your financial goals and do not compromise your core financial well-being.

- Regular Portfolio Reviews: Regularly review your investment portfolio, including cryptocurrency holdings. Assess the performance of your digital coins, consider rebalancing if needed, and ensure that your overall portfolio remains in line with your risk tolerance and financial objectives.

- Emergency Fund and Liquidity: Maintain an emergency fund separate from your investments, including cryptocurrencies. Having readily accessible funds ensures that you can cover unexpected expenses without having to liquidate your digital coins during unfavorable market conditions.

- Diversification Beyond Cryptocurrencies: While cryptocurrencies offer diversification, ensure that your overall investment portfolio is well-diversified across various asset classes. This approach helps mitigate risk and provides a balanced strategy for long-term financial health.

- Stay Informed about Regulatory Developments: Cryptocurrency markets are subject to regulatory changes. Stay informed about regulatory developments in the jurisdictions where you operate. Awareness of potential regulatory shifts allows you to adapt your investment strategy accordingly.

- Tax Considerations: Understand the tax implications of cryptocurrency investments. Different jurisdictions may have varying tax treatments for digital assets. Seek professional advice to ensure compliance with tax regulations and optimize your tax position.

- Seek Professional Advice: Given the complexities of cryptocurrency investments, consider seeking advice from financial professionals with expertise in the digital asset space. A qualified financial advisor can provide personalized guidance based on your financial situation and goals.

Conclusion:

A financial health checkup involves assessing and improving your money situation across various dimensions. Cryptocurrency investments and digital coins can be valuable components of your financial portfolio, offering diversification and potential growth opportunities. However, strategic considerations, including risk assessment, security measures, and alignment with overall financial goals, are crucial. Regularly review your portfolio, stay informed, and adopt a prudent approach to cryptocurrency investments to ensure that they contribute positively to your long-term financial health. As with any investment, knowledge, careful planning, and ongoing evaluation are key to navigating the dynamic landscape of cryptocurrency markets successfully.