Introduction:

In a world driven by financial decisions, instilling a foundation of money smarts in the next generation is a vital investment in their future. Financial education for kids not only empowers them with essential life skills but also lays the groundwork for responsible money management. In this article, we’ll explore the importance of teaching kids about money and provide practical strategies for nurturing financial literacy from an early age.

The Importance of Financial Education for Kids:

- Building Lifelong Habits: Introducing financial concepts to children creates a foundation for lifelong habits. By instilling good money practices early on, kids are better equipped to make informed financial decisions as adults.

- Empowering Independence: Financial education fosters independence and responsibility. Kids who understand the value of money are more likely to develop sound decision-making skills, enabling them to manage their finances confidently.

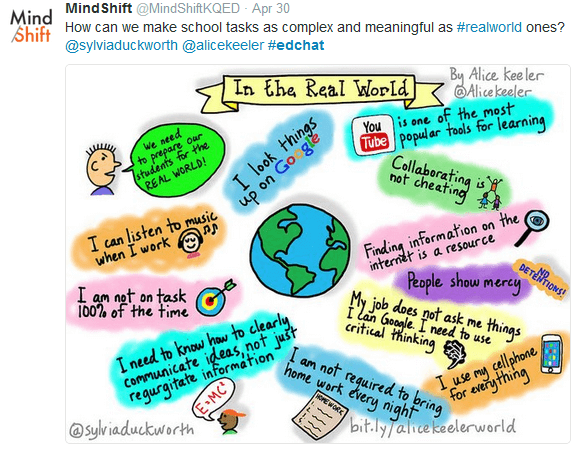

- Real-World Preparation: As children grow, they will encounter various financial scenarios. Teaching them about money provides practical skills for navigating real-world situations such as budgeting, saving, and making informed purchase decisions.

Strategies for Teaching Financial Education to Kids:

- Start Early with Basic Concepts: Introduce basic financial concepts in an age-appropriate manner. For young children, use tangible items like play money or piggy banks to explain the concept of earning, saving, and spending.

- Create a Money-Smart Environment: Involve kids in age-appropriate discussions about family finances. While you don’t need to disclose all details, discussing the importance of budgeting and saving fosters a money-smart environment.

- Use Practical Examples: Relate financial concepts to everyday activities. For example, involve kids in grocery shopping and discuss budgeting, comparison shopping, and making choices based on needs versus wants.

- Set Up a Savings System: Help kids establish a savings system, whether it’s a piggy bank, a savings account, or an online tool. Encourage them to save a portion of their allowance or gift money, teaching the value of delayed gratification.

- Introduce the Concept of Earning: Teach kids about the connection between work and money. Consider assigning age-appropriate chores with associated rewards, helping them understand the concept of earning and the value of hard work.

- Utilize Technology: Leverage educational apps and online resources designed to teach financial literacy. Interactive tools can make learning about money engaging and enjoyable for kids of all ages.

- Incorporate Games and Simulations: Engage kids in financial education through games and simulations. Board games or online platforms that simulate real-life financial scenarios can be both educational and entertaining.

- Encourage Goal Setting: Teach kids about setting financial goals. Whether it’s saving for a toy, a special outing, or college, goal setting instills the importance of planning and working toward objectives.

- Model Responsible Behavior: Children learn by example. Demonstrate responsible financial behavior by discussing your own financial decisions, emphasizing the importance of saving, budgeting, and making informed choices.

Conclusion:

Financial education for kids is a powerful tool for equipping the next generation with essential life skills. By starting early, creating a money-smart environment, and incorporating practical strategies like savings systems, goal setting, and age-appropriate discussions, parents and educators can nurture a foundation of financial literacy in children. The investment in financial education today ensures that kids grow into adults who are well-prepared to navigate the complexities of the financial world with confidence and competence. Remember, teaching money smarts is not just about dollars and cents; it’s about empowering kids to build a secure and successful future.