Introduction:

In a world where financial decisions shape our daily lives, adopting smart spending strategies becomes essential for optimizing resources and achieving financial goals. Making every dollar count involves thoughtful planning, informed decision-making, and a commitment to value. In this article, we’ll explore smart spending strategies that empower individuals to maximize the impact of their dollars, ensuring a more efficient and fulfilling financial journey.

Understanding Smart Spending:

- Quality Over Quantity: Smart spending prioritizes quality over quantity. Instead of pursuing numerous low-cost items, focus on acquiring fewer, higher-quality goods or services that offer lasting value and satisfaction.

- Mindful Budgeting: Create a realistic budget that aligns with your financial goals and priorities. Mindful budgeting allows you to allocate funds strategically, ensuring that each dollar serves a purpose in advancing your financial well-being.

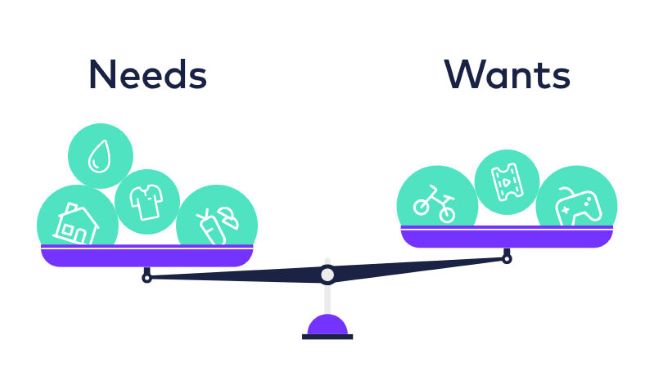

- Differentiating Wants from Needs: Distinguish between wants and needs when making purchasing decisions. Prioritize essential items and services while being mindful of discretionary spending on non-essential wants.

Smart Spending Strategies:

- Comparison Shopping: Before making a purchase, conduct thorough research to compare prices, features, and reviews. Utilize online resources, customer testimonials, and price comparison tools to ensure you get the best value for your money.

- Leveraging Technology and Apps: Embrace technology and utilize apps to find discounts, track expenses, and manage your budget effectively. Many apps offer cashback rewards, price alerts, and budgeting features that can enhance your smart spending efforts.

- Taking Advantage of Rewards Programs: Enroll in rewards programs offered by retailers, credit cards, and loyalty schemes. Accumulating points, cashback, or discounts through these programs can significantly increase the value of your purchases over time.

- Delaying Gratification: Practice delayed gratification by resisting impulsive purchases. Take time to evaluate whether a purchase aligns with your priorities and financial goals before committing.

- Prioritizing Essential Spending: Prioritize spending on essential items such as housing, utilities, groceries, and healthcare. Ensuring your basic needs are met forms the foundation for effective smart spending.

- Bulk Purchases for Savings: Consider buying in bulk for frequently used items. This strategy often results in lower per-unit costs and reduces the frequency of shopping trips, saving both time and money.

- Investing in Quality: Invest in quality products or services that offer durability and long-term value. While the initial cost may be higher, the extended lifespan often justifies the expense, resulting in savings over time.

- Negotiating Prices: Don’t hesitate to negotiate prices, especially for big-ticket items or services. Many sellers are open to price negotiations, providing an opportunity to secure a better deal.

Making Every Dollar Count in Daily Life:

- Meal Planning and Cooking at Home: Plan meals in advance and cook at home to save on dining expenses. Not only is this more cost-effective, but it also allows you to make healthier choices and reduce food waste.

- Embracing Second-Hand Purchases: Explore second-hand or thrift stores for clothing, furniture, and other items. Quality second-hand purchases can offer significant savings while contributing to sustainable consumption.

- DIY Projects and Repairs: Embrace do-it-yourself (DIY) projects and simple repairs to save on labor costs. Many tasks, from basic home repairs to crafting projects, can be accomplished with online tutorials and a bit of creativity.

- Subscription Audits: Regularly review your subscriptions, canceling those that no longer align with your interests or priorities. This ensures that you’re not paying for services you don’t fully utilize.

Conclusion:

Smart spending is not about restricting yourself but about making intentional choices that align with your values and financial objectives. By adopting these smart spending strategies, you can make every dollar count, allowing you to build financial security, pursue your goals, and lead a more fulfilling life. Whether you’re comparing prices, embracing technology, prioritizing essential spending, or investing in quality, the key is to approach every financial decision with mindfulness and purpose. Remember, the impact of smart spending extends beyond your wallet; it empowers you to shape a more intentional and prosperous financial future.