Introduction:

Effective financial planning starts with a well-structured budget. Whether you’re aiming to save for a major purchase, build an emergency fund, or pay off debts, creating a budget is a crucial step towards achieving your financial goals. In this article, we will explore practical tips for crafting a budget that works and empowers you to take control of your finances.

Understanding the Importance of Budgeting:

- Clarity of Financial Goals: A budget provides clarity on your financial goals by outlining your income, expenses, and savings. It acts as a roadmap, helping you allocate resources toward specific objectives such as debt repayment, savings, or investments.

- Expense Tracking: Creating a budget involves tracking your expenses meticulously. Understanding where your money goes allows you to identify areas for potential savings and make informed decisions about your spending habits.

- Emergency Preparedness: A well-structured budget includes provisions for unforeseen circumstances. Allocating funds to an emergency fund within your budget ensures you have financial resilience in the face of unexpected expenses.

Practical Tips for Creating an Effective Budget:

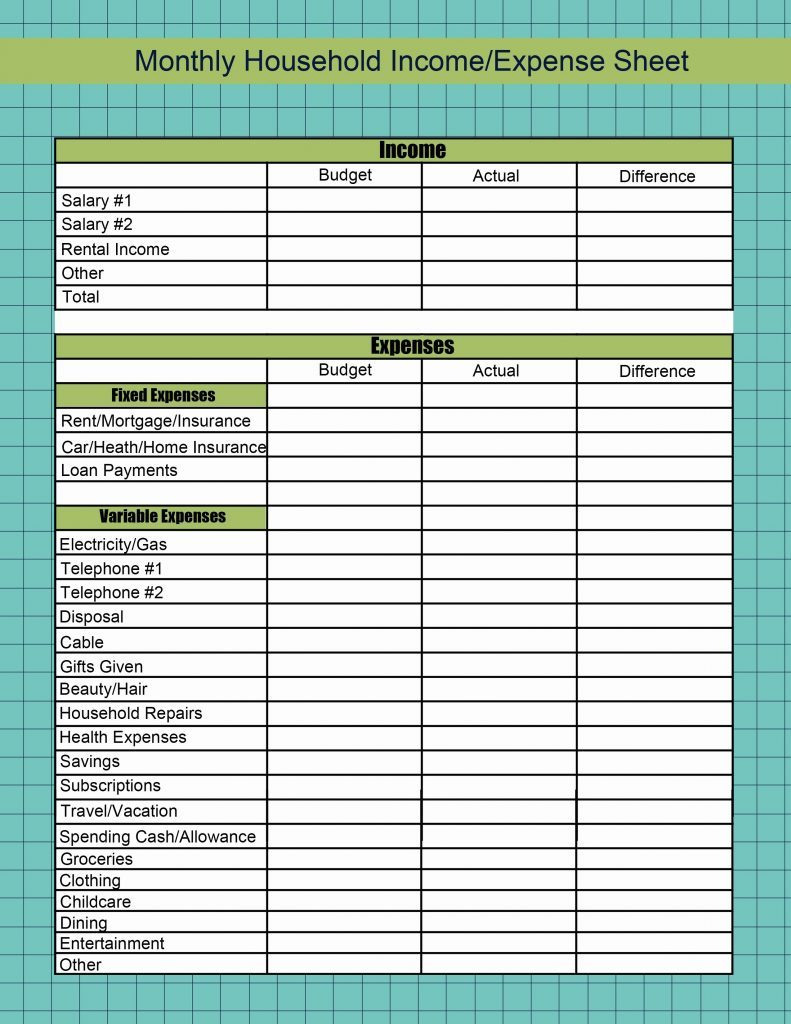

- Calculate Your Income and Expenses: Start by determining your monthly income, including salary, freelance earnings, or any additional income streams. Next, list all your fixed and variable expenses, including rent or mortgage, utilities, groceries, transportation, and entertainment.

- Categorize Your Expenses: Categorizing expenses helps you gain a better understanding of your spending patterns. Common categories include housing, utilities, food, transportation, healthcare, and entertainment. Allocate specific amounts to each category based on your past spending habits and financial goals.

- Set Realistic Goals: Establish realistic and achievable financial goals. Whether you’re aiming to save a certain percentage of your income, pay off debt, or build an emergency fund, ensure your goals align with your current financial situation.

- Prioritize Debt Repayment: If you have outstanding debts, allocate a portion of your budget to debt repayment. Prioritize high-interest debts to minimize interest payments and accelerate your journey towards financial freedom.

- Build in Flexibility: Life is unpredictable, and unexpected expenses may arise. Build flexibility into your budget to accommodate these unforeseen circumstances without jeopardizing your financial stability.

- Regularly Review and Adjust: Your financial situation evolves over time. Regularly review your budget, making adjustments as needed. This ensures your budget remains aligned with your financial goals and accommodates any changes in income or expenses.

Conclusion:

Creating a budget that works is a foundational step toward achieving financial success. By understanding the importance of budgeting, calculating your income and expenses, categorizing your spending, setting realistic goals, prioritizing debt repayment, building in flexibility, and regularly reviewing and adjusting your budget, you can take control of your finances and work towards a more secure financial future. Remember, a well-crafted budget is a dynamic tool that evolves with your financial journey, providing the framework for achieving your financial aspirations.