Introduction:

Embarking on the journey to financial success and wealth building requires a strategic approach and disciplined financial planning. In this comprehensive guide, we will explore the essential steps to help you achieve your wealth-building goals. Whether you’re just starting or looking to enhance your financial well-being, these key strategies will pave the way for a more secure and prosperous future.

- Create a Solid Financial Plan: The cornerstone of any successful wealth-building journey is a well-crafted financial plan. Start by setting clear financial goals, both short-term and long-term. Establish a budget that aligns with your income and expenses, allowing you to allocate funds towards savings and investments.

- Invest Wisely: Diversifying your investments is crucial for wealth building. Explore different investment vehicles such as stocks, bonds, real estate, and mutual funds. Conduct thorough research or consult with a financial advisor to build an investment portfolio that aligns with your risk tolerance and financial objectives.

- Emergency Fund: Building wealth involves preparing for unforeseen circumstances. Create an emergency fund to cover at least three to six months’ worth of living expenses. This financial cushion provides a safety net during unexpected events like job loss or medical emergencies, preventing setbacks in your wealth-building journey.

- Debt Management: Effectively managing and reducing debt is a key component of wealth building. Prioritize paying off high-interest debts first and adopt a disciplined approach to avoid accumulating unnecessary liabilities. Reducing debt not only frees up funds for saving and investing but also improves your overall financial health.

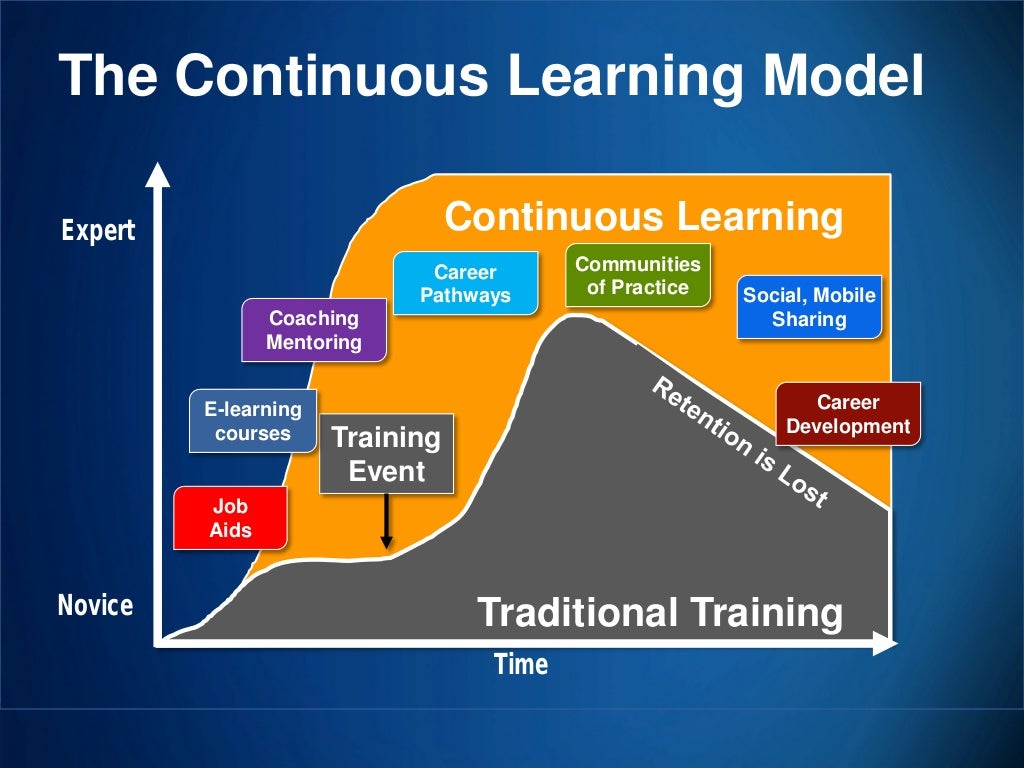

- Continuous Learning: Stay informed about personal finance and investment strategies. Attend workshops, read financial literature, and follow reputable financial experts to enhance your knowledge. Continuous learning empowers you to make informed decisions, adapt to changing economic conditions, and optimize your wealth-building efforts.

- Maximize Retirement Contributions: Contributing to retirement accounts is a powerful wealth-building tool. Take advantage of employer-sponsored retirement plans like 401(k) or individual retirement accounts (IRAs). Maximize contributions to benefit from tax advantages and ensure a secure financial future during retirement.

- Income Streams: Explore additional income streams beyond your primary source of income. This could include side hustles, freelancing, or passive income through investments. Diversifying your income sources adds resilience to your financial portfolio and accelerates wealth accumulation.

Conclusion:

Wealth building is a holistic journey that involves strategic planning, disciplined execution, and continuous learning. By creating a solid financial plan, investing wisely, establishing an emergency fund, managing debt, pursuing continuous learning, maximizing retirement contributions, and diversifying income streams, you can lay the foundation for financial success. Remember, each step contributes to the overall success of your wealth-building strategy, bringing you closer to achieving your financial goals.