Introduction:

Advanced budgeting is not solely about managing personal finances; it’s a strategic tool that, when used innovatively, can extend its impact beyond individual wealth. In this article, we’ll explore the intersection of philanthropy and finance, showcasing advanced budgeting techniques that go beyond traditional money management and have a positive impact on both wealth and society.

The Role of Philanthropy in Advanced Budgeting:

While the primary goal of budgeting is often associated with personal financial goals, integrating philanthropy into your financial plan adds a unique dimension. The synergy between giving back and managing wealth can lead to a more fulfilling and impactful financial journey.

Advanced Budgeting Techniques with a Philanthropic Focus:

- Allocating a Philanthropy Fund: Incorporate a dedicated philanthropy fund into your budget. This fund allows you to allocate a percentage of your income specifically for charitable contributions. Designating a fixed amount ensures consistency in giving back while fitting seamlessly into your overall financial plan.

- Strategic Charitable Planning: Elevate your charitable giving by strategically planning your contributions. Identify causes that align with your values and financial capacity. Consider creating a multi-year giving plan, allowing for more impactful donations to organizations that resonate with you.

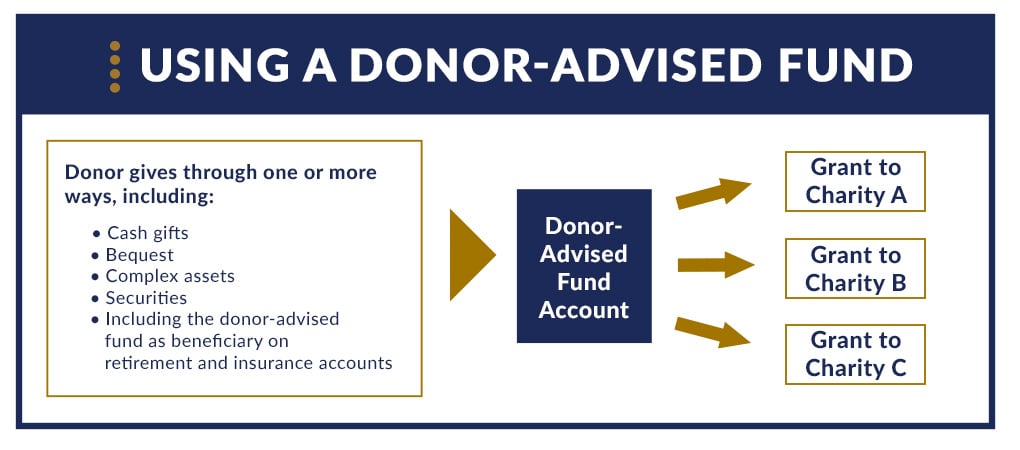

- Impactful Donor-Advised Funds: Establishing a donor-advised fund (DAF) can be a powerful philanthropic and financial tool. Contributing to a DAF provides an immediate tax benefit, and you can strategically distribute funds to selected charities over time. This advanced budgeting technique allows for both strategic giving and tax optimization.

The Impact of Giving Back on Wealth:

- Fulfillment Beyond Financial Gains: Beyond the monetary benefits of advanced budgeting, integrating philanthropy into your financial plan adds a layer of personal fulfillment. The knowledge that your financial success contributes to positive change in the world enhances the overall impact of your wealth.

- Community Engagement and Networking: Philanthropy often involves community engagement and networking. By actively participating in charitable initiatives, you not only make a difference but also expand your network. This can lead to valuable connections, both personally and professionally, potentially influencing your financial journey positively.

- Tax Advantages of Charitable Contributions: Taking advantage of tax benefits associated with charitable contributions can further optimize your financial plan. Understanding and strategically leveraging these incentives can enhance your overall financial picture while supporting causes you care about.

Maximizing Impact on Wealth through Advanced Budgeting:

- Aligning Philanthropy with Financial Goals: Integrate philanthropic goals seamlessly into your overall financial plan. Align your giving strategy with your long-term financial objectives, ensuring that your charitable contributions complement, rather than compromise, your wealth-building efforts.

- Measuring and Tracking Impact: Incorporate metrics to measure the impact of your philanthropic efforts. Tracking the outcomes of your charitable contributions allows you to assess the effectiveness of your giving strategy and adjust it over time, ensuring your contributions make a meaningful difference.

- Educating Future Generations: Consider including philanthropy education as part of your financial legacy. Educate your family about the importance of giving back, instilling a sense of responsibility and impact that extends beyond individual wealth.

Conclusion:

Advanced budgeting techniques can elevate your financial plan from a personal endeavor to a force for positive change. By incorporating philanthropy and finance, you not only fine-tune your budgeting strategies but also make a lasting impact on both your wealth and the world around you. Embrace the power of giving back, integrate philanthropy into your financial plan, and let your advanced budgeting techniques be a catalyst for positive change in society and the fulfillment of your financial goals.